Self employed paycheck calculator

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Use SmartAssets paycheck calculator to calculate your take.

Amazing Way To Take Health Insurance As A Tax Deduction Tax Deductions Health Insurance Tax Deductions List

Get ideas on common industry.

. Ad Compare This Years Top 5 Free Payroll Software. As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. Normally the 153 rate is split half-and-half.

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Calculate your adjusted gross income from self-employment for the year. For example say year one the business.

132900 in 2019 then all. The combined tax rate is 153. In a few easy steps you can create your own paystubs and have them sent to your email.

Ad Search For Self Employed Payroll Calculator Now. Employed and self-employed tax calculator. Calculate your 2019 2020 Self Employment Taxes for FREE with absolutely no sign up.

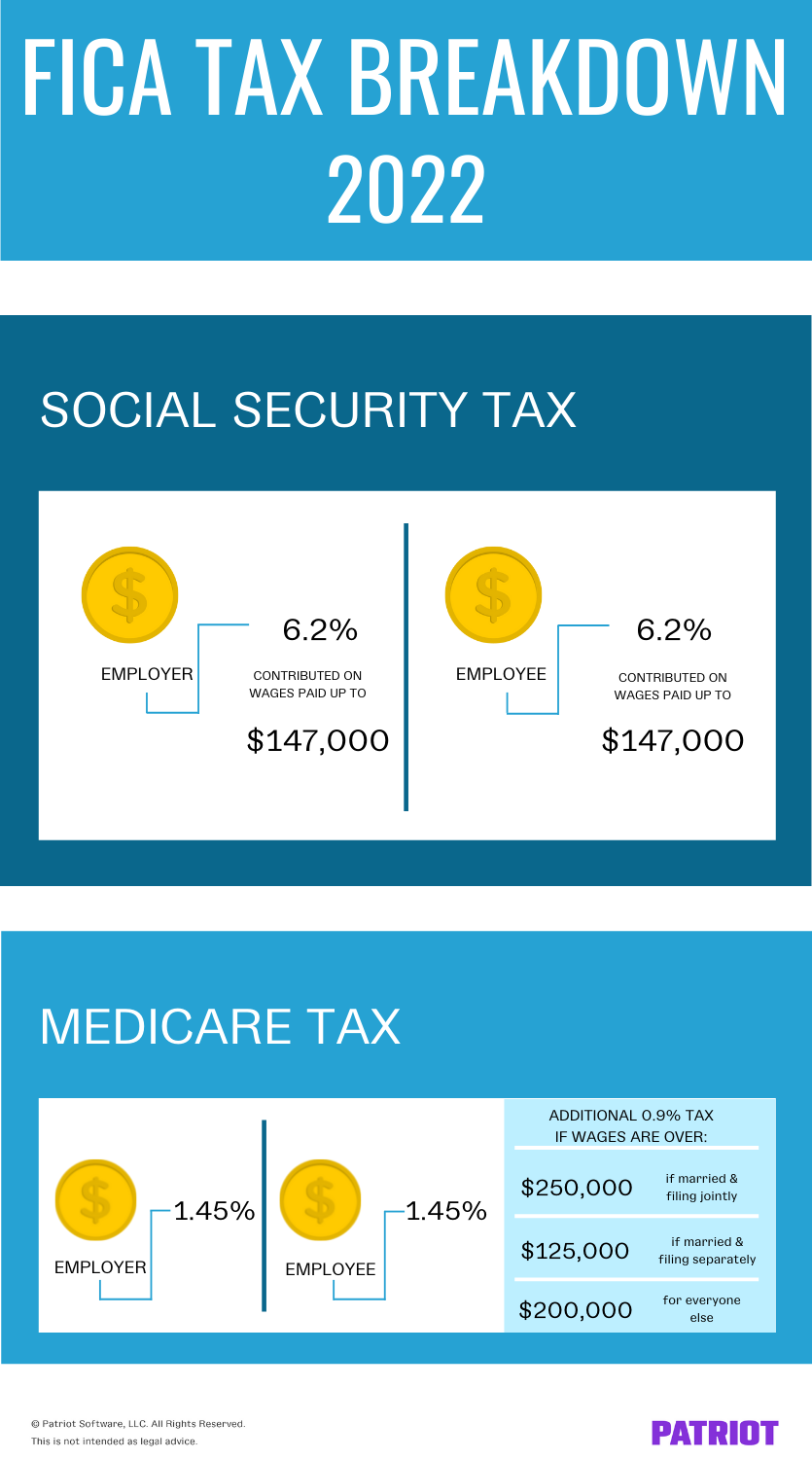

This percentage is a combination of Social Security and Medicare tax. Here is how to calculate your quarterly taxes. Self-employment tax consists of 124 going to Social Security and 29 going to Medicare.

See what happens when you are both employed and self employed. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Can be used by salary earners self.

The Social Security portion has a limit on how much of your income is taxed. This is your total income subject to self-employment taxes. Self-employed workers are taxed at 153 of the net profit.

Use this simple calculator to quickly calculate the tax and other deductions that are taken from income. Free Unbiased Reviews Top Picks. Fast Easy Affordable Small Business Payroll By ADP.

The tax rate is calculated on 9235 of your total self-employment income. Social Security and Medicare. Get 3 Months Free Payroll.

They calculate your income by adding it up and dividing by 24 months. The rate consists of two parts. How do I calculate my monthly self-employment income.

Get 3 Months Free Payroll. We use the most recent and accurate information. Employed and Self Employed uses tax information from the tax year 2022 2023 to show you take-home pay.

Ad Create professional looking paystubs. Ad Make Payroll Management East With Simple Paycheck Templates. Ad Learn How To Make Payroll Checks With ADP Payroll.

This is your total income subject to self-employment taxes. Payroll Software So Easy You Can Set It Run It Up Yourself. Ad Payroll So Easy You Can Set It Up Run It Yourself.

This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. Ad Learn How To Make Payroll Checks With ADP Payroll. Quickly and securely get a personalized tax estimate.

Fast Easy Affordable Small Business Payroll By ADP. When you put together a business budget youll need to include the amounts you have to pay towards Tax and National Insurance NI. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235.

The self-employment tax rate is 153. Get 3 Months Free Payroll. Self employment taxes are comprised of two parts.

Self-employed workers are taxed at 153 of the net profit. Use the IRSs Form 1040-ES as a worksheet to determine your. Use our Self Employed Calculator and Expense Estimator to find common self-employment tax deductions write-offs and business expenses for 1099 filers.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Whether youre employed self-employed or a combination of both working out your take home pay after tax can be tricky. No Matter What Your Tax Situation Is TurboTax Has You Covered.

Get 3 Months Free Payroll. In 2022 income up to 147000 is subject to the 124 tax paid for the. Ad Use Our TurboTax Tax Calculator And Uncover All Your Work-Related Deductions Today.

Enter your total employment wages and tips that you have been paid where Social Security taxes have been deducted. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235. Our self-employed and sole trader income calculator.

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of. Use this Self-Employment Tax Calculator to estimate your. Taxes Paid Filed - 100 Guarantee.

Self Employment Tax Calculator For 2021 Good Money Sense Self Employment Business Tax Deductions Small Business Tax

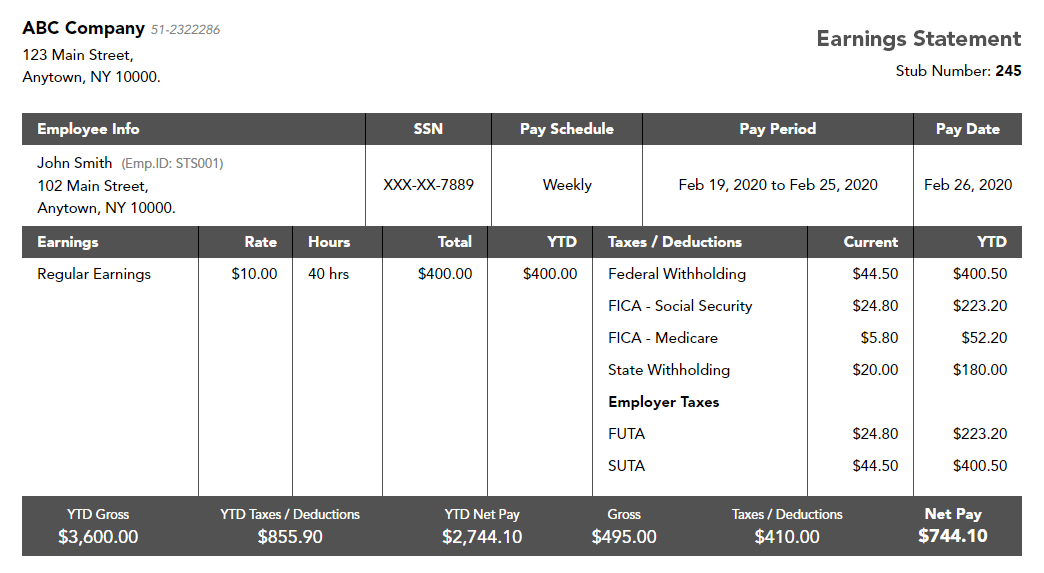

Payroll Calculator Free Employee Payroll Template For Excel

Independent Contractor Paystub 1099 Pay Stub For Contractors

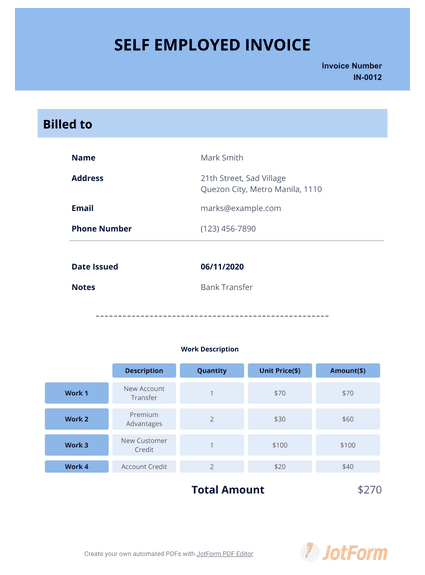

Self Employed Invoice Template Pdf Templates Jotform

How Much Should You Pay Yourself A Free Calculator Small Business Bookkeeping Small Business Accounting Small Business Finance

Self Employment Tax Calculator For 2021 Good Money Sense Income Tax Preparation Self Employment Business Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment 1099s And The Paycheck Protection Program Bench Accounting Self Employment Paycheck Payroll Taxes

Taxcalc Ie An Irish Income Tax Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Psoxtu8f1yk2sm

Agi Calculator Adjusted Gross Income Calculator

How To Pay Your Nanny S Taxes Yourself Nanny Tax Nanny Payroll Payroll Template

/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

What Is Social Security Tax Calculations Reporting More

What Are Payroll Deductions Article

Self Employed Taxes How To Calculate Your Tax Payments Business Money Tax Money Advice